More About Canada Installment Loans

Wiki Article

Installment Loans Online for Dummies

Table of ContentsAn Unbiased View of Installment Loans OnlineThe Facts About Installment Loans Canada Uncovered4 Easy Facts About Installment Loans Online ExplainedThe Definitive Guide for Installment Loans CanadaAll About Fast Installment Loans OnlineSome Known Questions About Bad Credit Installment Loans Online.

"Installment car loan" is a broad, basic term that refers to the frustrating bulk of both individual and commercial loans prolonged to customers., there are some pros and also cons to take into consideration.Brokers Lamina Review from Lamina Brokers on Vimeo.

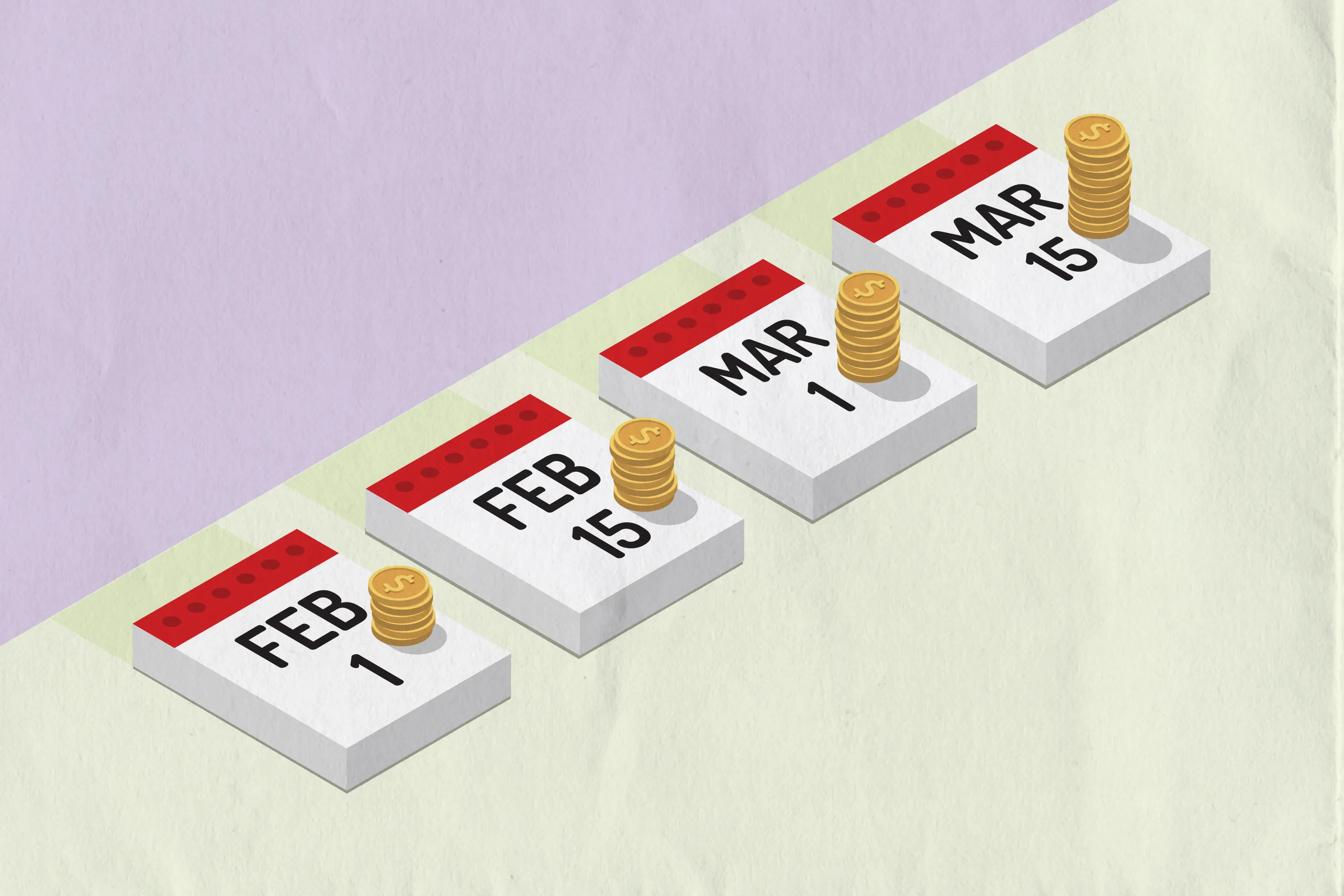

Installment fundings are individual or business financings that debtors should pay back with frequently set up payments or installations. For each installment repayment, the consumer repays a part of the major obtained as well as pays passion on the loan. Examples of installation loans consist of vehicle finances, mortgage lendings, personal car loans, and also pupil finances.

The normal repayment amount, generally due monthly, remains the very same throughout the lending term, making it easy for the borrower to budget plan ahead of time for the required payments. Borrowers normally need to pay other fees along with rate of interest costs on installment loans. Those can consist of application processing costs, car loan source charges, and prospective added fees such as late repayment costs.

Not known Details About Canada Installment Loans

Aside from home mortgages, which are often variable-rate finances, where the rates of interest can change during the term of the financing, almost all installment car loans are fixed-rate financings, meaning that the rate of interest billed over the regard to the finance is repaired at the time of borrowing. Installment car loans might be either secured (collateralized) or unprotected (non-collateralized).Some installment lendings (frequently referred to as individual fundings) are prolonged without collateral being required. The rate of interest price billed on an unsafe finance is generally greater than the price on a similar protected lending, showing the greater threat of non-repayment that the financial institution accepts.

, the term of the funding, the repayment schedule, and the payment amounts.

The smart Trick of Canada Installment Loans That Nobody is Talking About

The lending institution will additionally examine the borrower's credit reliability to identify the quantity of debt as well as the funding terms that the lender is eager to provide. The debtor ordinarily repays the car loan by making the needed payments each month. Consumers can typically save interest fees by settling the financing before the end of the term embeded in the finance arrangement, unless there are charges for doing so.Repaying an installation lending on schedule is an exceptional method to develop your credit history. Settlement background is the single most important variable that adds to your credit scores score, and a lengthy track record of on-time payments benefits your debt score. On the other hand, your credit report can take a hit if you do not make prompt payments or you fail on the loanwhich is a significant warning in the eyes of loan providers.

Yes, you may be able to get an installation financing even if you have negative credit rating. You will usually have to pay a greater interest rate than if your credit scores was in far better shape. You might likewise be more likely to be authorized for a secured car loan than an unsafe one in that scenario.

The smart Trick of Installment Loans Online That Nobody is Talking About

installment loans canada

An installation finance is an advance that has the provision of being settled over a certain period of time via a set number of scheduled settlements. The tenure of the funding may extend from a few months to up to thirty years.

Examine This Report on Bad Credit Installment Loans Online

Generally, these types of finances are granted and serviced locally, as well as require the client to settle back the principal together with the built up rate of interest, using regular repayment installations. The frequency and also timetable of the payment installations are repaired before the disbursement of the financing.

The convenience and also speed of applying, and getting access to the needed advance, provides an included benefit to the one in demand. Why waste your priceless time stumbling upon the lending institution's office, when you can obtain the lending from the convenience of your home! All you need to do is, open your laptop computer and also see the lender's internet site wherein you can simply fill out the lending application and also obtain the money within 24 hr.

Some Known Facts About Installment Loans Canada.

offers you our exclusive Cashco flex fundings that can involve your rescue when you are in a monetary situation. There are numerous instances in a person's life time that command immediate monetary focus, as well as most of individuals are not truly furnished with the big quantities of money required to manage them.Or, you unexpectedly experienced an automobile break down, as well as wanted you had some extra cash stashed away for conference unexpected expenditures such as this. Whatever the requirement of the hour perhaps, the lower line is that you call for a lot of cash rapidly (fast installment loans online). There could be specific credit-rating problems, which are limiting the financial institution from lending you a breakthrough.

Report this wiki page